Introduction

Embark on a journey to demystify self-assessment tax, delving into the intricacies of this taxation strategy. This comprehensive guide provides insights into self-assessment processes, using Oswaal’s self-assessment paper solutions as a tool for mastering this approach.

Unveiling the Essence of Self-Assessment Tax

Decoding Self-Assessment Taxation

Define self-assessment tax and its role in the income tax system. Explore how this method empowers taxpayers to calculate and report their own tax liability, emphasizing the responsibility it places on individuals for accurate reporting.

Benefits of Self-Assessment Tax

Discuss the benefits of opting for self-assessment tax, highlighting the flexibility, convenience, and potential for tax optimization it offers to individuals and businesses. Illustrate scenarios where self-assessment becomes a strategic choice.

Navigating Oswaal’s Self-Assessment Paper Solutions

Oswaal’s Contribution to Self-Assessment Education

Introduce Oswaal’s self-assessment paper solutions as a valuable resource for individuals seeking to understand and implement self-assessment tax strategies. Discuss the reputation and reliability of Oswaal’s educational materials.

Key Features of Oswaal’s Self-Assessment Solutions

Explore the key features of Oswaal’s self-assessment paper solutions, emphasizing their user-friendly design, comprehensive coverage, and practical approach. Discuss how these solutions cater to diverse learning needs.

Implementing Oswaal’s Solutions in Tax Planning

Provide practical insights into implementing Oswaal’s self-assessment solutions in tax planning. Discuss how the solutions can be utilized to understand tax concepts, solve problems, and optimize tax liabilities.

ACLS Precourse Self-Assessment: A Parallel Perspective

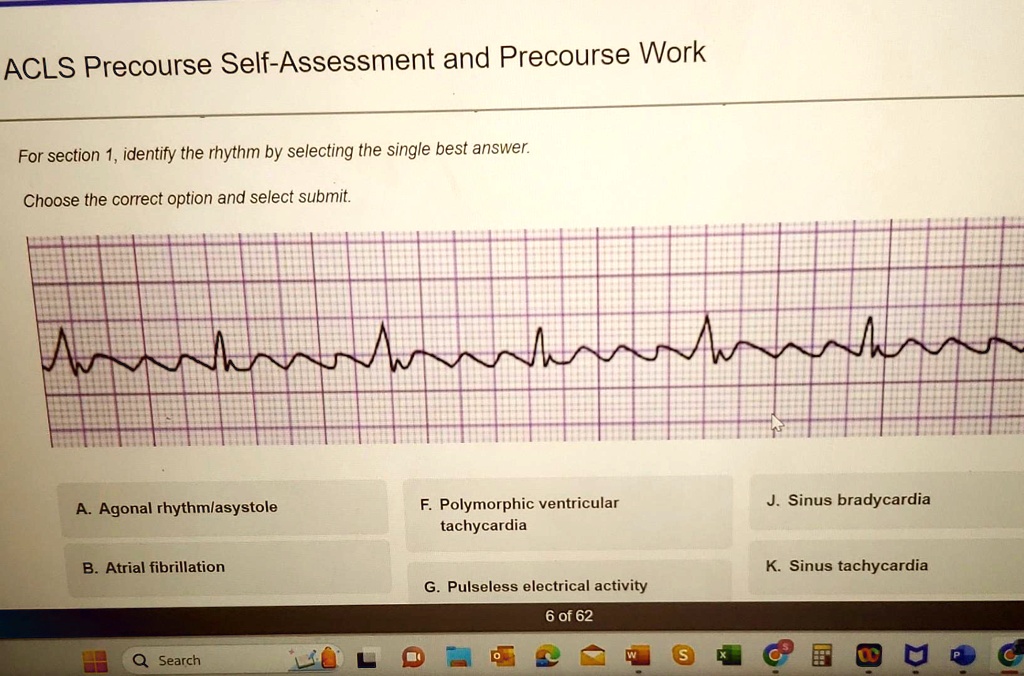

Parallel Insights from ACLS Precourse Self-Assessment

Draw parallels between self-assessment tax strategies and the ACLS precourse self-assessment. Discuss how both involve personal evaluation, preparation, and strategic planning to achieve desired outcomes.

Translating ACLS Strategies to Tax Planning

Explore the application of strategies learned through ACLS precourse self-assessment to the realm of tax planning. Discuss the shared principles of preparedness, evaluation, and strategic decision-making.

Steps to Effective Self-Assessment Taxation

Initiating the Self-Assessment Process

Guide individuals through the initial steps of self-assessment tax, emphasizing the importance of gathering necessary documents, understanding tax laws, and preparing for accurate reporting.

Utilizing Oswaal’s Solutions for Calculations

Provide a step-by-step guide on utilizing Oswaal’s self-assessment solutions for accurate tax calculations. Illustrate examples and scenarios to enhance understanding, ensuring users can navigate complex tax scenarios.

Addressing Common Challenges in Self-Assessment

Discuss common challenges individuals may encounter in the self-assessment process and provide practical solutions. Cover topics such as understanding deductions, dealing with complex income sources, and ensuring compliance.

The Oswaal Advantage in Self-Assessment Mastery

Testimonials and Success Stories

Present testimonials and success stories from individuals who have mastered self-assessment using Oswaal’s solutions. Highlight real-world examples of how these resources have empowered users in their tax journeys.

Continuous Learning with Oswaal’s Resources

Emphasize the value of continuous learning with Oswaal’s resources beyond self-assessment tax. Discuss how their materials can be used for ongoing tax education, staying abreast of regulatory changes, and enhancing financial literacy.

Conclusion: Empowering Individuals Through Self-Assessment Excellence

Conclude the guide by summarizing the key takeaways and empowering individuals to excel in self-assessment tax. Emphasize the role of Oswaal’s solutions in this journey and encourage users to embrace self-assessment as a powerful tool for financial control and tax optimization.